EUR/USD

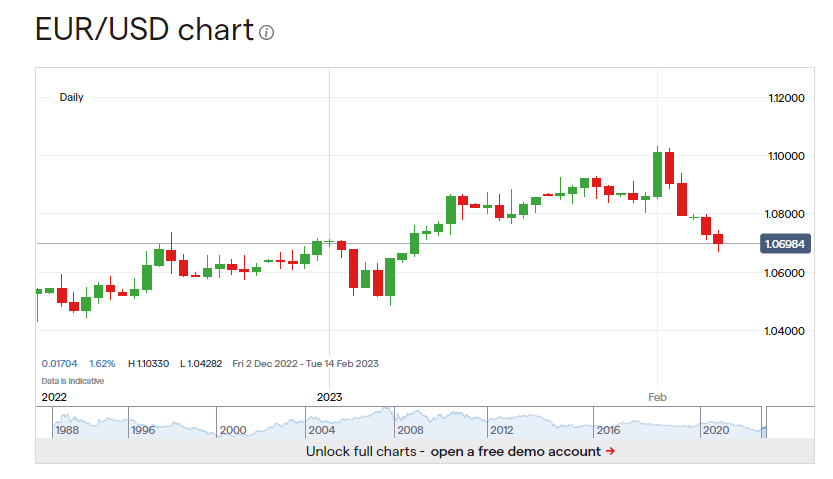

EUR/USD Live Chart

EUR/USD Trading Conditions

Minimum size 1

Contract size EUR 100,000

One Pip means 0.0001 USD/EUR

Value of one Pip USD 10 (GBP 8.33)

Margin 3.33%

Minimum stop distance 3

Minimum guaranteed stop distance 5

Your aggregate position in this market will be margined in the following tiers:

| Tier | Position size | Margin |

| 1 | 0 – 11.5 Contracts | 3.33% |

| 2 | 11.5 – 115 Contracts | 3.33% |

| 3 | 115 – 172.5 Contracts | 3.33% |

| 4 | 172.5 + Contracts | 6% |

If your aggregate position is larger than Tier 1, your margin requirement will not be reduced by non-guaranteed stops.

Related Products

About EUR/USD

The EUR/USD currency pair has a rich and interesting history that reflects the economic dynamics of Europe and the United States.

The euro was introduced as a virtual currency in 1999, with physical banknotes and coins being introduced in 2002. The common currency was created to promote economic integration and stability in Europe, and it quickly became a major player in the global currency market.

On the other hand, the US dollar has been the dominant global currency for much of the 20th century, and it remains so to this day. The US economy is the largest in the world, and the US dollar is used as the primary currency in international trade and finance.

Since the introduction of the euro, the EUR/USD currency pair has been heavily traded, with the exchange rate between the two currencies reflecting the relative strength of the European and US economies. The financial crisis of 2008 had a major impact on the pair, as the eurozone struggled with a debt crisis and the US economy showed signs of recovery.

Since then, the EUR/USD has been characterized by fluctuations reflecting changing economic conditions in Europe and the United States. Despite this volatility, the currency pair remains an important barometer of the health of the global economy and a popular choice among currency traders.

EUR/USD FAQ

What factors should one consider when trading the EUR/USD currency pair?

When trading the EUR/USD currency pair, traders should consider the following factors:

- Economic data releases, such as interest rates, GDP, and inflation figures, which can impact the relative strength of the euro and the US dollar.

- Political developments, such as elections and policy decisions, which can have a significant impact on the currencies.

- Market sentiment and technical analysis, which can provide insight into the short-term direction of the currency pair.

- The actions of central banks, such as the European Central Bank and the Federal Reserve, and any monetary policy decisions they may make.

- Global events and market risk sentiment, such as geopolitical tensions and natural disasters, which can impact market stability and cause temporary fluctuations in currency values.

It’s important to keep a close eye on these factors and have a well-thought-out trading strategy to make informed decisions when trading the EUR/USD currency pair.

When is the best time to trade EUR/USD?

The best time to trade the EUR/USD currency pair depends on various factors, including a trader’s risk tolerance and personal trading strategy. However, some general guidelines are:

- During periods of high volatility: When market conditions are rapidly changing, the EUR/USD currency pair can experience significant price swings, providing opportunities for short-term traders.

- During active market hours: The most liquid and active trading times for the EUR/USD currency pair are when the European and US financial markets are open, which are generally from 2:00 AM to 12:00 PM Eastern Standard Time.

- During key economic data releases: The release of important economic data, such as interest rate decisions, GDP, and inflation figures, can result in sudden price movements in the EUR/USD currency pair. Traders who trade based on these events may look to take advantage of such movements.

It’s important to keep in mind that the forex market is open 24/7 and can be influenced by events and news at any time, so having a well-thought-out trading strategy and being aware of key market events is crucial for successful trading of the EUR/USD currency pair.

What are the best EUR/USD trading strategies?

The best EUR/USD trading strategies depend on a trader’s individual goals and risk tolerance. Here are some commonly used strategies:

- Position trading: This involves holding a currency position for an extended period, sometimes for several weeks or months, and aims to benefit from longer-term price movements.

- Trend following: This strategy involves identifying a dominant trend in the market, either bullish or bearish, and following it by taking a long or short position.

- Breakout trading: This strategy involves identifying key levels of support and resistance and taking a position once the price breaks through one of these levels.

- News trading: This strategy involves taking advantage of sudden price movements that can occur following the release of important economic data or news events.

- Range trading: This strategy involves identifying a range-bound market and taking advantage of buying low and selling high within that range.

It’s important to keep in mind that no single strategy is guaranteed to be successful, and traders should be prepared for losses as well as potential profits. A well-diversified portfolio that takes into account a trader’s goals and risk tolerance is often the best approach.

Is EUR USD a good pair to trade?

The EUR/USD currency pair is considered to be one of the most traded and widely followed currency pairs in the forex market. It is considered a good pair to trade because of its liquidity and high trading volume, which can lead to tight bid-ask spreads and increased price stability.

Additionally, the euro and the US dollar are two of the largest and most developed economies in the world, making the EUR/USD pair an ideal barometer for global economic conditions. Economic releases and central bank decisions from both the European Union and the United States can have a significant impact on the exchange rate between the two currencies, providing traders with numerous trading opportunities.

However, it’s important to remember that the forex market can be unpredictable, and currency values can be influenced by a wide range of factors, including geopolitical events and market sentiment. So while the EUR/USD pair can offer many trading opportunities, it’s important to approach it with caution and a well-thought-out trading strategy.